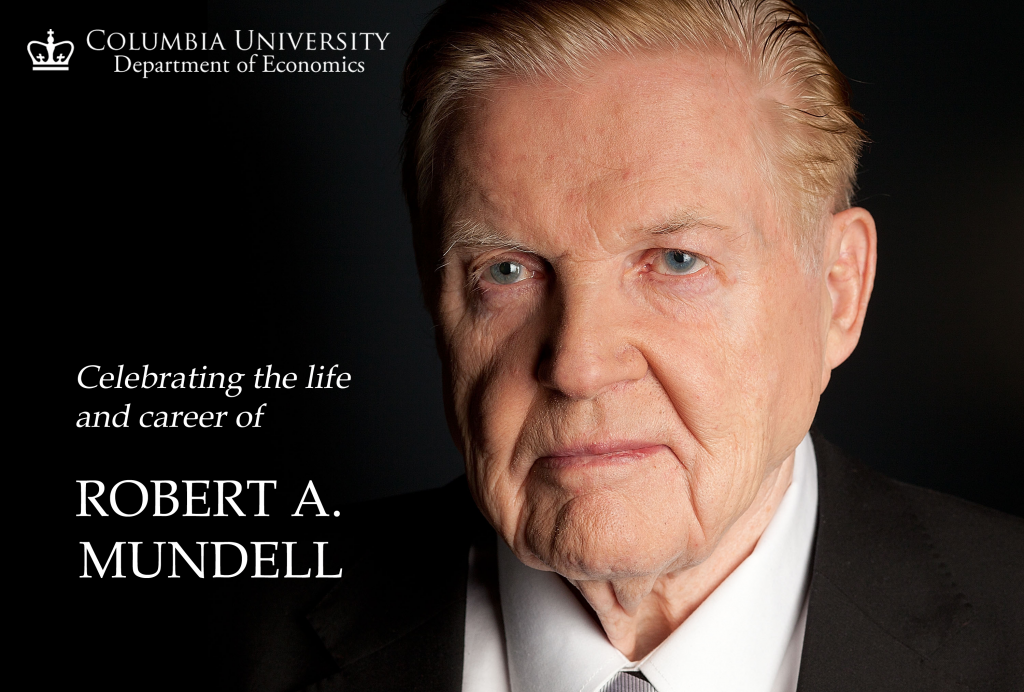

With the death of Robert Mundell, age 88, the economics profession has lost a giant. Bob made landmark contributions to economic theory and policy beginning with his journal articles extending Keynesian theory to an open economy in the 1960s. He went on to create in the 1970s what became known as supply-side economic policy, which the Reagan administration put into practice in the 1980s. Later he became an important advocate of the creation of the euro. In 1999, he was awarded the Nobel Prize in Economics.

We at Columbia got to see more of him when we managed to recruit him to the Economics Department in 1974 where he remained for 40 years. His presence came in time to help us enormously with the recruitment of a new staff of macroeconomists in the 1970s. Stanley Fischer commented once in 1979 that Columbia had the best department for macroeconomics in the world.

Bob lent a cosmopolitan tone to Columbia when he started the Santa Colomba Conferences on International Monetary Reform in Santa Colomba, Siena, in Tuscany. There, many of us met some of the movers and shakers in economic policy making such as Paul Volcker.

Remarkably, Mundell began a new phase in his career when, early in the 2000s, he started up the Nobel Laureates Beijing Forum and became an advisor to China’s central bank.

A link to his obituary in The New York Times can be found by clicking here.

Memorial Program

On Friday, Nov 11, 2022, we celebrated the life and career of Robert Mundell, at St. Paul’s Chapel, Columbia University. Click here to see a copy of the memorial program.

Memorial Video

(long version)

Memorial Video

(short version)

Memorial Video

Tribute to Robert Mundell by Maurice Obstfeld

Written Statements

Statement from Philip Lane

Both as an academic economist and as a central banker, the pioneering work of Bob Mundell in international monetary economics has shaped my thinking throughout my career. In terms of the economics of the euro, let me cite three ways in which his work continues to be essential. First, with the causal origins of the 2008-2012 crises serving as a primary proof by contradiction, policy makers in each member country of the euro area must deeply understand the implications of a common currency for national macroeconomic dynamics, in view of the absence of adjustable national exchange rates. Second, the globalisation of the world economy means that international financial flows and exchange rates are primary macroeconomic influences even for continental-sized monetary systems such as the euro, such that the design of optimal monetary and fiscal policies for the euro area are heavily influenced by his contributions. Third, Mundell was farsighted in recognising the potential benefits of a common currency, which are especially large in today’s world in which common shocks predominate and the euro facilitates coordinated policy responses among the member countries.

At a personal level, I learned a lot from Bob Mundell at the start of my career, when I was an assistant professor at Columbia University. In particular, during this period, I recall his wide-ranging contributions to the dinner discussions after the Wednesday international economics seminar, sharing many insights into the historical development of international monetary economics as a field. He was also great fun.

It was a career highlight to contribute a paper on the relation between monetary policy and the current account to the festschrift in his honour that was organised by Guillermo Calvo, Rudi Dornbusch and Maury Obstfeld. I was also very pleased to invite him to Trinity College Dublin in 2001, where he delivered a fascinating keynote lecture on the initial years of European monetary union.

Statement from Richard Clarida

I deeply regret that , due to a longstanding prior speaking commitment in Boston, I am unable to attend this memorial service to honor the incredible life and towering academic accomplishments of Bob Mundell. I became aware of Bob initially through his pathbreaking research that I studied as a graduate student at Harvard in the 1980s, and later through my collaborations with his students, especially Jacob Frenkel and Mike Mussa. For someone, such as myself, who was interested in international monetary economics at a time when few of my contemporaries were, Bob’s writings were beacons of clarity and insight which stood out in an otherwise murky sea of anecdotes and inconclusive conjectures. Bob of course is known as the “father of the Euro” and through his Nobel Prize , he justly regarded as the father of the field we today call “international money and finance”. When I joined the Columbia faculty as an assistant professor in 1988 , I made to point to introduce myself to Bob and asked Mike and Jacob to facilitate the connection. I wanted Bob to know I respected and was inspired by his work and over time, he began to include me in high level conferences he was organizing in the 1990s in advance of the launch of the Euro, I vividly remember one such conference in Bologna Italy which included Bob, Paul Volcker, Otmar Issing, Richard Cooper …and , thank to Bob, me and in a prominent speaking role. That meant the world to me at the time and to this day, I often think back at the dinner that followed the conference with Bob, Paul Volcker, and Otmar Issing over a bottle or three of wine discussing the future of what would become the Eurozone and the role of the dollar in this brave new world. The economics profession and the community of international policymakers will sorely miss Bob Mundell, the academic, and I will miss him also as a mentor and friend.

Photo Gallery

All images © JAMES RANSOM

Amy E. Hungerford. Executive Vice President for Arts and Sciences and Dean of the Faculty of Arts and Sciences and Ruth Fulton Benedict Professor of English and Comparative Literature

Amy E. Hungerford. Executive Vice President for Arts and Sciences and Dean of the Faculty of Arts and Sciences and Ruth Fulton Benedict Professor of English and Comparative Literature

Paul Robin Krugman. Distinguished Professor of Economics at the Graduate Center of the City University of New York

Paul Robin Krugman. Distinguished Professor of Economics at the Graduate Center of the City University of New York

Paul Robin Krugman. Distinguished Professor of Economics at the Graduate Center of the City University of New York

Paul Robin Krugman. Distinguished Professor of Economics at the Graduate Center of the City University of New York

Paul Robin Krugman. Distinguished Professor of Economics at the Graduate Center of the City University of New York

Paul Robin Krugman. Distinguished Professor of Economics at the Graduate Center of the City University of New York

Paul Robin Krugman. Distinguished Professor of Economics at the Graduate Center of the City University of New York

Paul Robin Krugman. Distinguished Professor of Economics at the Graduate Center of the City University of New York

Paul Robin Krugman. Distinguished Professor of Economics at the Graduate Center of the City University of New York

Paul Robin Krugman. Distinguished Professor of Economics at the Graduate Center of the City University of New York