Capital Fund Management (CFM), along with the Journal of Investment Strategies (JOIS) is inviting original, previously unpublished manuscripts on the topic of ESG and alternative investment strategies. The author(s) of the winning paper will be offered a €10,000 cash prize, along with an invitation to present his/her/their work to the CFM research team in Paris or New York.

Capital Fund Management (CFM), along with the Journal of Investment Strategies (JOIS) is inviting original, previously unpublished manuscripts on the topic of ESG and alternative investment strategies. The author(s) of the winning paper will be offered a €10,000 cash prize, along with an invitation to present his/her/their work to the CFM research team in Paris or New York.

Interested authors should submit their manuscript to: esg-investing@cfm.fr spring 2023; further details TBA.

Events (Past and Upcoming)

Generative AI: Transformation or Hype? November 28, 2023

Generative AI: Transformation or Hype?

Generative AI: Transformation or Hype?Alternative Data in Crypto Markets is part of the ongoing CFM-PER Alternative Data Initiative.

This event has passed. View a recording on YouTube here.

About:

The release of Chat-GPT on November 20, 2022 led many, including a number of Big Tech CEOs and Wall Street, to herald the transformative potential of Generative AI for the global economy. But just as many argue that it is hype and contributing to a Big Tech Bubble. As Charlie Munger of Berkshire Hathaway has quipped, “I think old-fashioned intelligence works pretty well.”

To address these issues, this event will feature a lecture by Chaired Professor Dr. Markus Leippold of the Department of Banking and Finance at the University Zurich and Visiting Researcher at Google Research. He has been at the forefront of using Generative AI to investigate a number of important issues in financial markets, such as stock market sentiment and climate change. He will bring both this academic research and practitioner expertise to bear on these pressing questions.

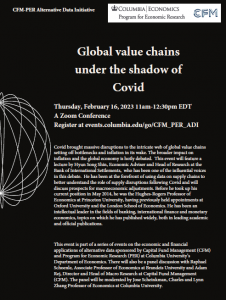

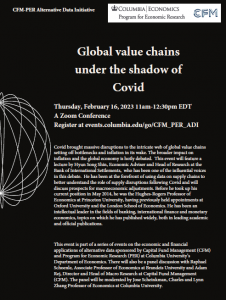

Global value chains under the shadow of Covid February 16, 2023

Global value chains under the shadow of Covid

Global value chains under the shadow of CovidAlternative Data in Crypto Markets is part of the ongoing CFM-PER Alternative Data Initiative.

This event has passed. View a recording on YouTube here.

About:

Covid brought massive disruptions to the intricate web of global value chains setting off bottlenecks and inflation in its wake. The broader impact on inflation and the global economy is hotly debated. This event will feature a lecture by Hyun Song Shin, Economic Adviser and Head of Research at the Bank of International Settlements, who has been one of the influential voices in this debate. He has been at the forefront of using data on supply chains to better understand the role of supply disruptions following Covid and will discuss prospects for macroeconomic adjustments. Before he took up his current position in May 2014, he was the Hughes-Rogers Professor of Economics at Princeton University, having previously held appointments at Oxford University and the London School of Economics. He has been an intellectual leader in the fields of banking, international finance and monetary economics, topics on which he has published widely, both in leading academic and official publications.

This event is part of a series of events on the economic and financial applications of alternative data sponsored by Capital Fund Management (CFM) and Program for Economic Research (PER) at Columbia University’s Department of Economics. There will also be a panel discussion with Raphael Schoenle, Associate Professor of Economics at Brandeis University and Adam Rej, Director and Head of Macro Research at Capital Fund Management (CFM). The panel will be moderated by Jose Scheinkman, Charles and Lynn Zhang Professor of Economics at Columbia University.

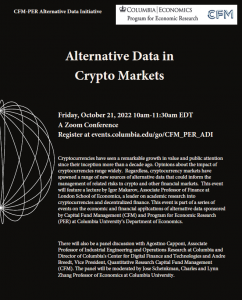

Alternative data in crypto markets October 21 2022

Alternative Data in Crypto Markets

Alternative Data in Crypto MarketsAlternative Data in Crypto Markets is part of the ongoing CFM-PER Alternative Data Initiative.

This even has passed. View the recording on youtube here.

View slides here:

About:

Cryptocurrencies have seen a remarkable growth in value and public attention since their inception more than a decade ago. Opinions about the impact of cryptocurrencies range widely. Regardless, cryptocurrency markets have spawned a range of new sources of alternative data that could inform the management of related risks in crypto and other financial markets. This event will feature a lecture by Igor Makarov, Associate Professor of Finance at London School of Economics, a leader on academic research into cryptocurrencies and decentralized finance. This event is part of a series of events on the economic and financial applications of alternative data sponsored by Capital Fund Management (CFM) and Program for Economic Research (PER) at Columbia University’s Department of Economics.

There will also be a panel discussion with Agostino Capponi, Associate Professor of Industrial Engineering and Operations Research at Columbia and Director of Columbia’s Center for Digital Finance and Technologies and Andre Breedt, Vice President, Quantitative Research Capital Fund Management (CFM). The panel will be moderated by Jose Scheinkman, Charles and Lynn Zhang Professor of Economics at Columbia University.

Measuring Geopolitical Risks, April 11, 2022

Measuring Geopolitical Risks

Measuring Geopolitical RisksThis event has passed. Measuring Geopolitical Risks is part of the ongoing CFM-PER Alternative Data Initiative.

Click here for zoom recording.

Click here for slides presented by Matteo Iacoviello

About:

Politics and international relations directly impact market conditions and geopolitical risk runs high during major crises like 9/11, the Iraq war or the Russian invasion of Ukraine. Elevated geopolitical risk leads to decline in real activity, lower stock returns and capital flows away from emerging markets and investors often struggle to correctly price in these effects. Can we quantify and systematically score the risk of disputes and hostilities between countries given the complexity of the context and the developments? This event is part of a series of events on the economic and financial applications of alternative data sponsored by Capital Fund Management (CFM) and Program for Economic Research (PER) at Columbia University’s Department of Economics.

This event will feature a talk by Matteo Iacoviello, Associate Director Division of International Finance, Federal Reserve Board, who will present his work on employing textual analysis of news articles to build a geopolitical risk index. There will also be a panel discussion with Simona Abis, Assistant Professor of Finance Columbia Business School, Matthieu Gomez, Assistant Professor of Economics Columbia University, and Phil Seager, Head of Absolute Return, for CFM. The panel will be moderated by Jose Scheinkman, Charles and Lynn Zhang Professor of Economics at Columbia University.

Corporate Debt and the Macroeconomy, December 9th, 2021

Corporate Debt and the Macroeconomy

Corporate Debt and the MacroeconomyThis event will take place on a Zoom conference on Thursday, December 9th at 11:00 a.m (EST). Corporate Debt and the Macroeconomy is part of the ongoing CFM-PER Alternative Data Initiative.

About:

Corporate debt markets play an increasingly important role in the macroeconomy. Shocks to these markets, whether during the financial crisis of 2008 or the recent COVID-19 episode, have severe impacts on economic growth. The goal of this event is to explore the use of data on debt contracts to understand these macroeconomic implications. This panel is part of a series of events on the economic and financial applications of alternative data sponsored by Capital Fund Management (CFM) and Program for Economic Research (PER) at Columbia University’s Department of Economics. The panel will feature a lecture by Yueran Ma, Assistant Professor of Finance at the University of Chicago Booth Graduate School of Business on how the use of microeconomic data and debt contracts can shed light on macro-finance channels and other important economic adjustment issues.

Rise of Retail Investors: Implications for Policy and Markets, June 29, 2021

This event will take place a Zoom conference on Tuesday, June 29th from 11:00 a.m. to 12:30 p.m. (EST). Rise of Retail Investors: Implications for Policy and Markets is part of the ongoing CFM-PER Alternative Data Initiative.

About:

The confluence of social media and technology has led to a resurgence of retail investor trading activity in financial markets, whether it is speculation on meme stocks like Gamestop or cryptocurrencies like Dogecoin. The goal of this event is to explore the use of big data regarding retail investor order flows to understand the implications of this resurgence for financial markets and regulators. This panel is part of a series of events on the economic and financial applications of alternative data sponsored by Capital Fund Management (CFM) and Program for Economic Research (PER) at Columbia University’s Department of Economics. The panel will feature a lecture by Charles Jones, Robert W. Lear Professor of Finance and Economics at the Columbia Business School.

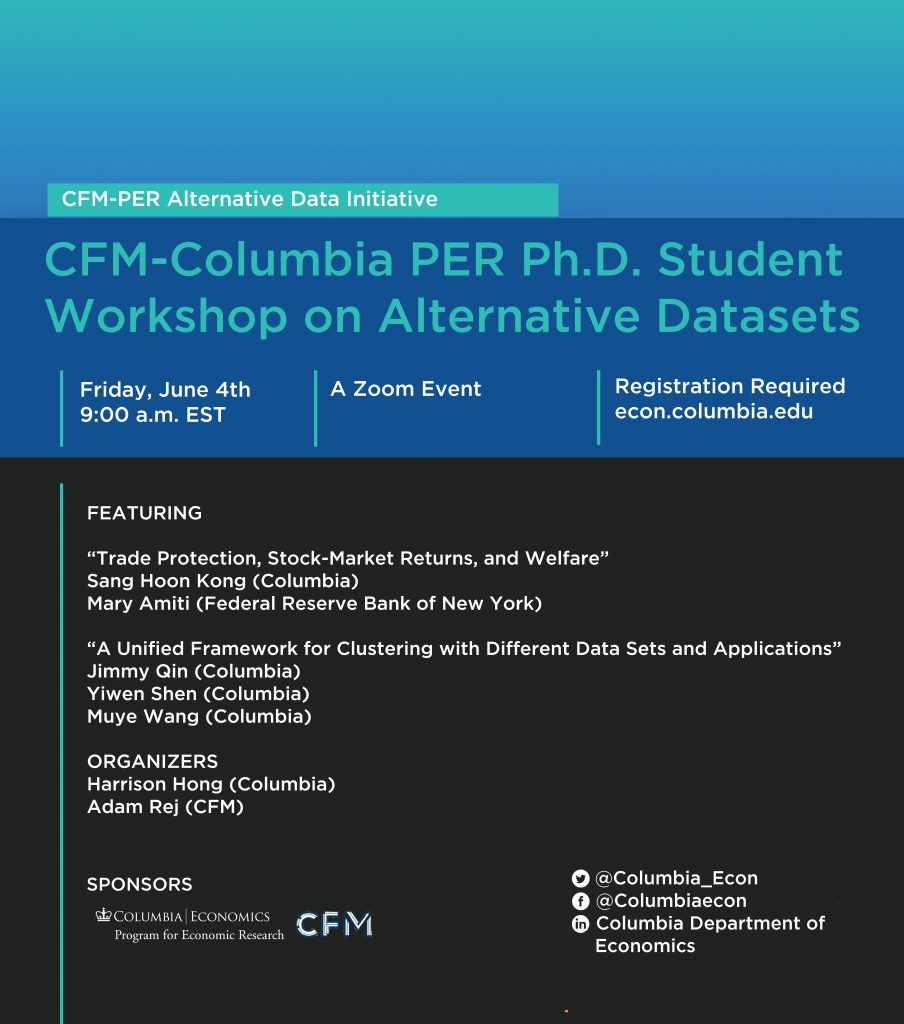

CFM-Columbia PER Ph.D. Student Workshop on Alternative Datasets, June 4, 2021

This event will take place a Zoom conference on Tuesday, June 29th from 9:00 a.m. to 10:00 a.m. (EST).

Nowcasting Inflation, March 25, 2021

This event will take place a Zoom conference on Thursday, March 25th from 11:00AM – 12:30PM (EST). Nowcasting Inflation is part of the ongoing CFM-PER Alternative Data Initiative.

About:

Trillions of dollars of stimulus by both monetary and fiscal authorities are leading to renewed concerns of inflation. The goal of this event is to explore the use of big data to generate high-frequency inflation forecasts. This panel is part of a series of events on the economic and financial applications of alternative data sponsored by Capital Fund Management (CFM) and Program for Economic Research (PER) at Columbia University’s Department of Economics. The panel will feature a talk by Alberto F. Cavallo, Edgerley Family Associate Professor of Business Administration at the Harvard Business School, and one of the preeminent researchers on this topic.

Geolocation Economics, May 4, 2020

This event will take place a Zoom conference on Monday, May 4th from 11:00AM to 1:00PM (EST). Geolocation Economics is part of the ongoing CFM-PER Alternative Data Initiative.

About:

Geolocation data from mobile phones and other digital platforms including payment are becoming increasingly available. The goal of the event is to explore the possible uses of this data for both industry and academic purposes. This panel is part of a series of events on the economic and financial applications of alternative data sponsored by Capital Fund Management (CFM) and Program for Economic Research (PER) at Columbia University’s Department of Economics. The panel will feature experts from leading geolocation data vendors and academic speakers that have leveraged such data to answer important questions such as modeling the dynamics of COVID-19, assessing spatial and social frictions, and evaluating the impact of rent control.

Leveraging Big Data to Manage Extreme Weather Risks?, November 12, 2019

Leveraging Big Data to Manage Extreme Weather Risks? is part of the ongoing CFM-PER Alternative Data Initiative.

About:

Extreme weather episodes such as Hurricane Sandy of 2012 and California Wildfires of 2018 led to significant human displacement and billions of dollars of economic damage spread across utility, real estate and other commercial sectors. Scientists predict that climate change will lead to more frequent and extreme weather risks. This evening panel is the first in a series of events on the economic and financial applications of alternative data sponsored by Capital Fund Management (CFM) and Columbia University’s Program for Economic Research (PER). A number of distinguished speakers and panelists will explore whether we can leverage big data from satellite images and machine learning algorithms to manage these risks in real time? The evening will consist of talks on recent improvements in remote sensing, the use of machine learning algorithms and applications for insurance and asset management.